Tuesday, October 4, 2022

Options for pricing services as you grow your financial coaching business.

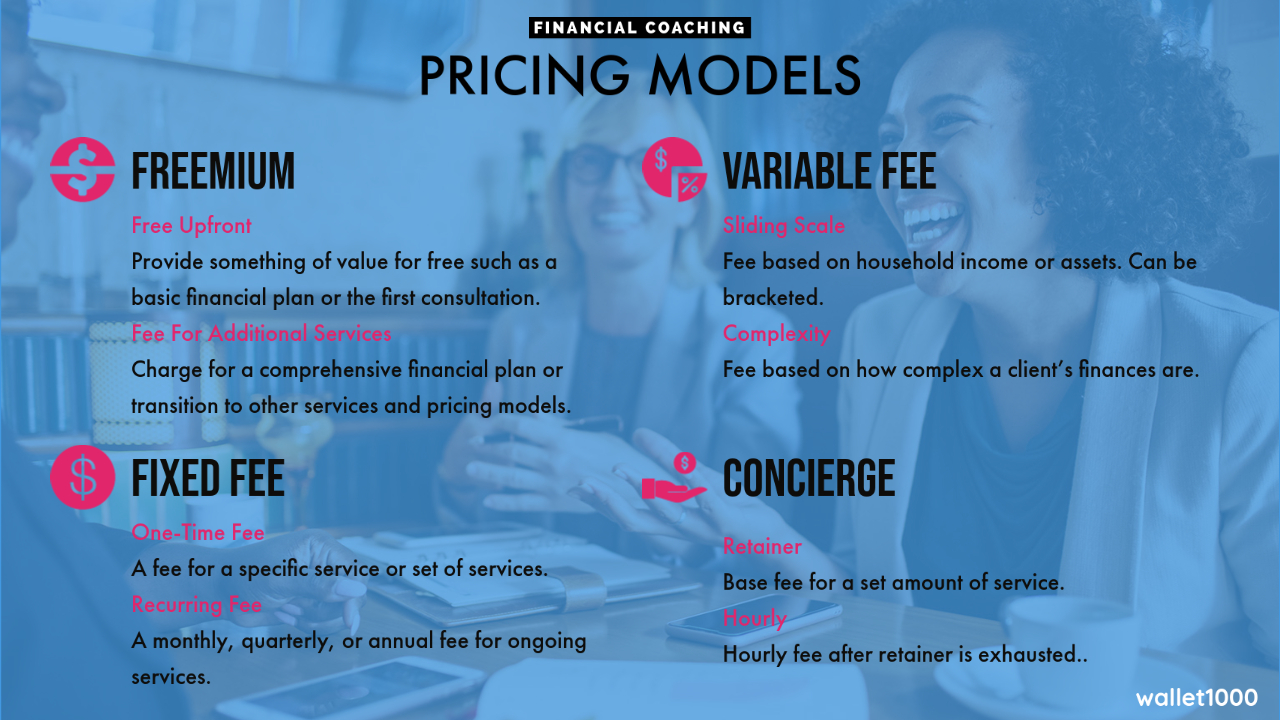

The model you choose for your financial coaching pricing impacts the types of clients you get, the amount of revenue you get, and the shape of your revenue stream. You need to find a pricing model that supports you and your business as well as working for your clients.

Here we explore a few different pricing models for you to consider as you build up your financial coaching business.

Freemium is a pricing model where you give away something for free with the hopes that the customer sees enough value to pay for upgraded service. A “free 30-minute consultation” is an example. The potential client will give you a quick overview of their finances and goals and you provide them a high-level plan to achieve them. Maybe some details on the first step for them to take. They would need to sign on as a client to get the full personalized playbook and ongoing coaching.

Certain financial planning software (such as Wallet1000) can help with this model. The prospect can enter their information into the planning portal and get the financial plan for free. The ongoing service is then provided for a fee.

Fixed fee financial coaching is the most common pricing model that we see. All services are included in a fixed cost. Often with higher income clients it is an annual fee while other clients may prefer paying a monthly or quarterly fee.

Due to the fact that the financial coaching work tends to be front-heavy (building the financial plan and the initial meetings take much longer than the ongoing follow-ups), it is wise to implement a minimum duration of the coaching engagement if you offer monthly pricing. You can let a client pay monthly as long as they commit to a minimum of six months of your service.

Wealth managers often price their services as a fee based on a percentage of assets. Comprehensive wealth management will include both planning and investment management and the advisory firm may charge a fee of a percentage of assets under management to cover both services.

Financial coaching usually does not involve investment management but there are other ways to do variable fees. You can charge on a sliding scale based on income. Clients with a gross household income under $100,000 could be one bracket and a $100k-$200k being another bracket, etc.

Another option would be to set fees based on the complexity of the client’s finances. (Tax planners do this.) A client in their 20s who is renting and only has credit card and student load debt is going to be simpler to plan for than a couple in their 40s with children, a mortgage, and a handful of retirement and non-retirement investment accounts.

The concierge method of pricing is the most interesting to me. Here a financial coach will charge a base fee (retainer) that includes a certain level of service as well as a set number of hours. That may be something like $1,000 for an annual financial plan update and eight hours of coaching. For any coaching beyond the eight hours the client will pay an hourly fee.

This pricing model is nice for the client in that they get some price certainty as well as feeling confident that they can schedule a meeting with their coach when the need arises.

Concierge pricing works for the coach because they get a guaranteed amount of revenue up front which provides income stability as well as money that can be used to invest in the business.

When you are just getting started you will probably work through a few different models based on what your clients ask for. In those early days, every client is important (every client is always important but the business depends on individual clients less as it grows) and you will work with their payment preferences.

Over time, you will be able to guide new clients to your preferred pricing method and move old clients over. You will also be able to raise prices as your expertise and the value you provide grows. Pricing is one of the best levers to increase your business’ revenue.

The shape of your revenue (all upfront, regular recurring, irregular bursts) can impact your business as much as the amount of revenue. You can’t pay today’s bills with tomorrow’s revenue.

Building your financial coaching business is a great journey. Spend time thinking about your business model. Your business is helping others so make sure that you are best positioned to do so.

Book a demo today if you are an employer or financial advisor and are looking for an amazing financial wellness solution for your participants.