Sunday, November 27, 2022

Learn how financial coaching works and how to help your clients achieve their goals.

Building a successful financial coaching business is something that takes time and determination. You need to channel your desire to help others and put in place the resources needed to acquire clients as well as developing your unique process for serving them.

Financial coaching helps people achieve their financial goals by looking to the future and identifying the steps needed to get there. Coaches help clients take those steps. They serve as guidance counselors and accountability partners.

Coaching is a forward-looking process with the focus being on what the client can do next rather than on what brought the client to where they are today.

In order to grow your business you need a deliberate process for acquiring new clients. This is something that your most successful competitors are doing. Without a process, you are applying guesswork to the marketing and sales that your business and livelihood depend on.

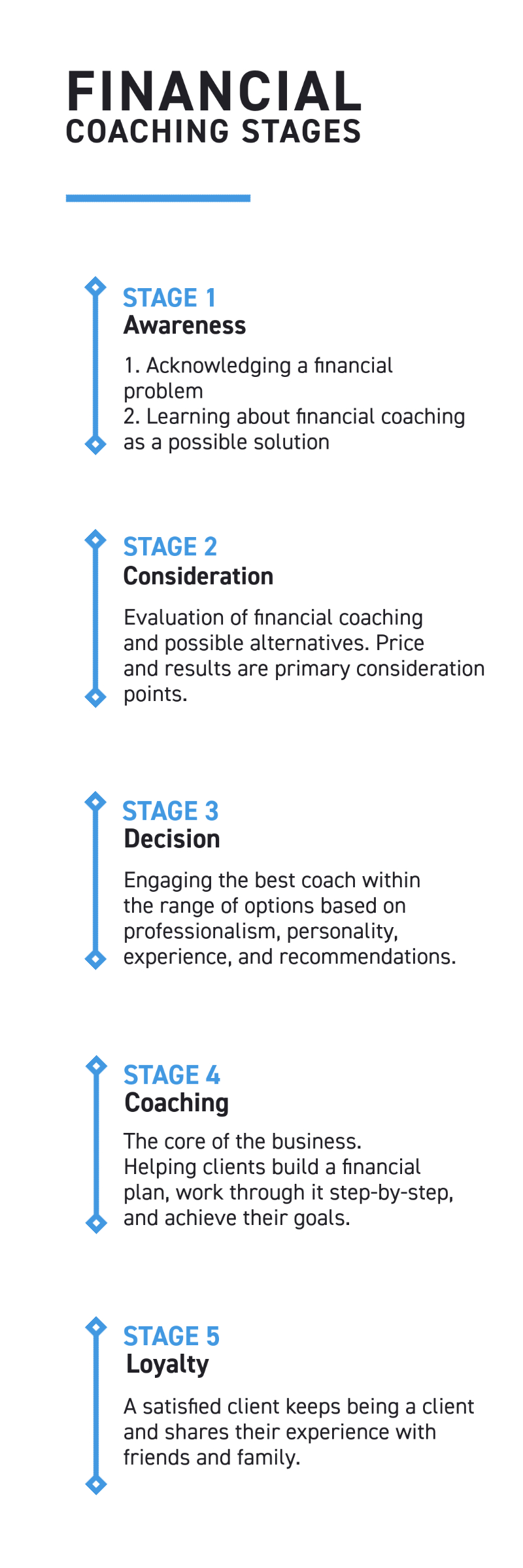

In this guide we are using the customer journey framework and applying it to the financial coaching process.

There are two distinct awareness events that happen in regard to financial coaching and there can be a lot of time between them. The individual acknowledging they have a financial problem and becoming aware of financial coaching as a possible solution. Those can occur in either order but the awareness stage is not complete until both events have occurred.

The financial “problem” in this stage may not even be a problem–maybe someone just wants a checkup and financial plan–but often it is. Too much debt, poor credit, or not enough funds for a financial goal. All of these are circumstances that many people face as well as where a common response is to bury the head in the sand and hope that the weather gets better.

In the awareness step, the individual acknowledges that burying their head and ignoring the problem is not going to make things better. Hope is not a financial plan. They transition from “I have a lot of debt” to “I have too much debt to live the life I want to and I need to put a plan in place to get out of it.” Or, “I want my kids to go to college” to “I may not have the money to pay for my kids’ colleges of choice unless I start saving now.”

“I have a financial problem but don’t yet know how to solve it.”

The second component of the awareness stage is the individual becoming aware of financial coaching. Many people don’t have any financial advisor outside a phone number or email address for their employer’s 401(k) provider. Some may have an “investment advisor” who is the person that just sold them a whole life policy. Often though, a financial advisor is something that wealthy people have and not something that the non-wealthy consider.

Someone may hear about financial coaching from a friend, come across it in social media, or learn that it is part of their benefits package.

After someone has acknowledged that they have a problem need help solving it, they start doing research about possible solutions. They will evaluate financial coaching and possible alternatives.

Here are some of the alternatives to hiring a financial coach that people may consider:

As a financial coach, you will need to be able to articulate why you are a better choice than the alternatives.

The evaluation process is likely going to be informal and could involve them working though the above list in reverse. If they don’t get results with one item (reading personal finance articles that appear in their social media feed) they may move onto the next one (trying a personal finance calculator).

The two main consideration points are going to be:

The higher the price the quicker someone expects to see results.

Make sure that your financial coaching website looks professional and provides the information that someone will be seeking in order to make their decision.

Someone will make a decision between the financial coaching options once they decided on coaching as the path forward. The research process may have been informal where they were mentally eliminating options as they did their research. Or, their research was more formal, and they now have a list of coaches they want to meet with before making their decision.

Potential clients are going to be evaluating you based on:

I just mentioned that having a good website is critical. If you were in the client’s shoes, would you choose the coach with the crappy website or one of the coaches with nice websites? Make sure that your site has high resolution images, good colors, makes effective use of white-space, and, most importantly, has convincing and error-free text.

After someone contacts you about scheduling an appointment you can send them a scheduling link (using Calendly or SavvyCal) that also incorporates your business’ logo.

Additionally, having a PDF (of success stories or a road map of the coaching process), eBook, or video that explains the process that you can send someone will help separate you from your competitors. These demonstrate that you are a professional and not just someone who passed the courses.

People always prefer to work with people they get along with. There are all types of people in the world, and we all have our own personalities. Don’t take it personally if you and a potential client don’t match up. A coach that is very analytical may be a poor choice for a client who is more emotional.

Actively listen to the potential client so that when you speak you are addressing what they have conveyed their needs and problems to be. This process is about them–not you.

Offering a free consultation, rather than just an introductory call, is one way to navigate the personality test. After the initial introduction, you can refocus the conversation on the process which will move the client to thinking about the problem and you as the solution.

Basically, the consultation is a shortcut to the planning process.

People are far more likely to buy based on a recommendation from friends or family than not. (5x more likely according to this source) Word of mouth advertising, or referrals, are one of the best ways to grow your business.

So, potential clients who come via a personal recommendation are more likely to become clients. That does not mean that those who found you organically will not become clients. Having “social proof” on your website in the form of testimonials is another tactic.

Some clients will value experience more than others. People can have a hard time taking advice from someone who is younger than them or newer to the industry. Other people are more open to hearing fresh perspectives or new approaches.

The only way to gain experience is to keep coaching. However, professional designations, case studies, and how you present yourself and your business will help demonstrate your experience and overcome objections that potential clients may have.

The more you are able to clearly discuss, using simple terms, the process, problems, and solutions the more that conveys experience.

Ultimately, the client is looking for results. You need to be able to demonstrate how your coaching, and your process, will deliver the results the client is looking for. Be specific. Don’t talk in generalizations. Your story (presentation) has gotten you to this point. Use figures to seal the deal.

A lot of financial advisors have a series of case studies they have built out in their financial planning software for this part of their sales process. This allows them to pull out one or two of the closest example plans that demonstrate what the plan and advice they gave to someone similar to the potential client.

Being honest and open goes a long way to building trust with the client. State any conflicts of interest, perceived or not, up front.

I didn’t list price above as price was one of the primary filters for the consideration step of the process. Clients will move into the decision phase only looking at coaching options in their price range.

The actual financial coaching process is covered in the next section. This is where you deliver your coaching services and help each client identify and achieve their financial goals.

You will use a variety of methods and tools for this and what works for one person may not work for another. Having a process is important but flexibility will be required. Each client has their unique set of circumstances and challenges that you are helping them navigate.

Loyalty happens in two ways:

If the coaching was not a one-time planning engagement, there is a renewal process that happens. That may happen automatically (with recurring charges) or may be an annual contract for coaching services that needs to be renewed. Either way, the client is happy with the service you are providing and are paying to continue working with you.

When a client is happy with you and the progress they are making they will naturally tell others about it. Sharing their experience is word-of-mouth marketing and helps you generate new business.

Typically, the client will share with their friends and family, but you can also ask them to review you online or to provide you a testimonial that you can put on your website.

Financial coaching process can be broadly broken down into three parts:

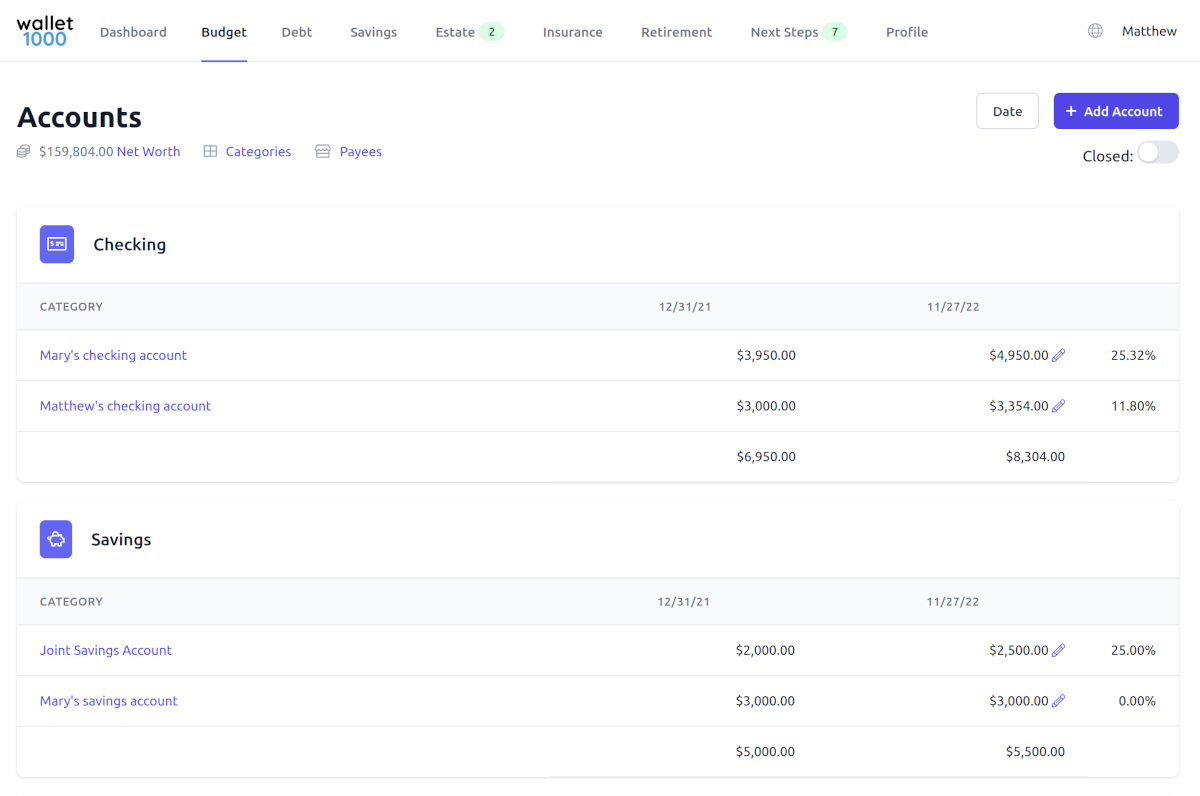

The initial meeting (after signing up the client) is where you work to establish the client’s current financial picture and their financial goals. You may provide the client some worksheets for this where they list their current assets, debts, spending, and insurance coverage. Financial coaching software can be used to gather that information digitally for immediate use in the financial plan. Alternatively, some clients are going to show up for the first meeting with stacks of bank and credit card statements for you to sift through.

At this point you take all of quantitative information you received from the client about balances and interest rates, along with the qualitative information about circumstance, worries, and goals, and use that to build your client’s financial plan.

The optimal financial plan is not necessarily the one that makes the most mathematical sense. The best financial plan is one that is actionable and achievable. Make sure that the financial plan adequately balances the financial picture with the life picture (time, family, career, and life constraints).

The client working through the financial plan is a loop. With each step there may be questions, setbacks, and surprises that creep up as the client takes the prescribed action.

For the client, maintaining focus on the single next action they need to take to accomplish the next step will yield better results than trying to accomplish multiple steps of the financial plan at once. Small wins add up to big wins.

However, one of the wonderful things about personal finances is being able to put certain things on autopilot. Setting up automatic savings transfers, share purchases, or direct debits is a small win in and of itself. Those then continue to build progress in the background as the client focuses on the next action.

The coach or advisor should keep track of the client’s actions and progress and set reminders to check in with the client on a regular basis. One of the main roles of a coach is to be proactive and supportive. (This also helps the client feel like they are getting ongoing value for the coaching or advising services they are paying for. The client may begin to question what they are paying for when there is too much time between communications.)

Each win does not necessitate a revision of the financial plan a quick update that shows the progress made to date provides a visual reminder that the work and sacrifice is building a better future for the client.

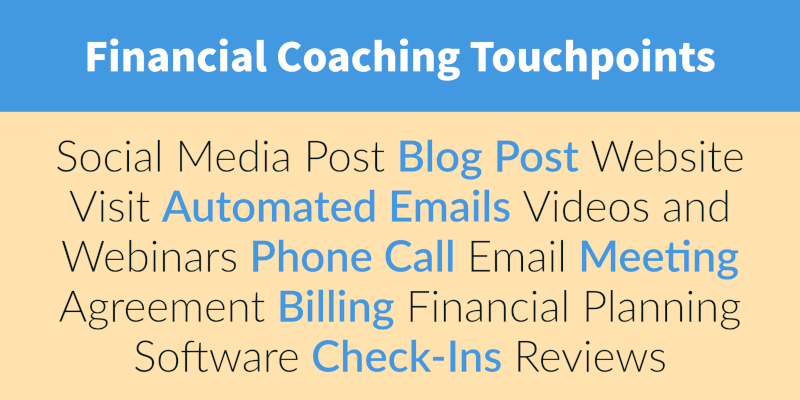

There are many touchpoints throughout the client journey. Each touchpoint should be viewed as an opportunity to provide a great experience and strengthen the relationship.

From a marketing perspective, the touchpoints start before you ever meet with the prospective client. They include anytime someone visits your site or reads your content. In fact, research says that seven touches are needed in order to make a sale. For higher-priced services such as financial coaching it may require more.

A post on social media may be the first touch for many potential clients. Quick finance tips or contrarian opinions may be something that your social media followers will reshare and thus expose your business to a new prospects.

Blog posts, white-papers, and case studies are another touch point that happens before the sale. Where social media may be a better lens into your personality, blog posts are where you can really put your expertise on display.

I am a fan of financial advisor marketing telling people what the advisor would do in a given situation (e.g. dealing with an estate, tax changes, etc.) with the result being that the prospective client recognizes the advisor as an expert on the situation and then pays the advisor to help them through the steps they just laid out.

After one or more touchpoints a prospect may be inclined to visit your website as part of the consideration stage of the client journey. Your website needs to make it easy for them to find the information they are looking for. It should also guide them to take the next step of the buying process using calls-to-action which can be an invitation so signup for a newsletter or email course or to schedule a meeting.

Automated emails, when someone has signed up for your mailing list, are a wonderful way to automate touches. These provide free value to the reader and demonstrate your expertise. Your business will be an option they consider when they are ready to move forward with hiring a coach.

Webinars are more often seen in the business-to-business (B2B) industry than in a consumer-based business such as financial coaching. In a webinar the speaker typically does a deep dive into a topic. That idea can be used, or they can be recorded, and put on YouTube.

Shorter form videos that provide answers to narrow questions are also popular on YouTube and social media platforms. Google often places YouTube videos at the top of search results so providing answers to niche questions in a video form can be a good way to get in front of potential clients.

The phone call needs no introduction but can easily be done wrong. The prospect and the advisor have different goals before the sale. The prospect is looking to gather information and the advisor is looking for the sale.

It is good to have a short agenda of a few bullet points, while at the same time practicing active listening and letting the prospect drive the conversation. Use the information they provide here (and any information they may have provided prior to this point) to steer this conversation as well as future touchpoints.

Email is an incredibly effective and efficient communication tool. You can send them at your convenience and read them at your leisure. Business professionals spend much of their days in their inbox so communicating with them there is important as part of your sales process and as part of your coaching practice.

Emails should be short and to-the-point. Make it clear what the next step is (e.g. scheduling a meeting) and do not ask too much of the prospect in any individual email.

Poor writing reflects poorly on you and your business. Don’t be overly informal in your emails and make sure to use proper spelling, punctuation, and grammar. Never put anything in an email that you would not want read aloud in public.

The in-person meeting is where deals get done (or in this case, when clients sign). Here, you connect with your prospect as a human being and where your empathy and understanding need to shine. By this point they have been sold on your expertise but are looking to make sure that you are a good match on a personal level.

One of the worst things you can do in an in-person meeting is to appear unorganized. Make sure you have everything you may need ready to go. If you require Internet, make sure that the mobile hot-spot on your phone works as a fallback.

Virtual meetings, using Zoom, are much more common these days and, if you are doing these, you need to have some mastery of the tool. Do not use tools that you do not know how to use!

Signing up for financial coaching services will necessitate some paperwork. Using Docusign or another e-signature service reduces friction for the client to sign up. The less steps the better.

Your financial coaching pricing deserves careful consideration. Regardless of whether you are billing a one-time fee or on a recurring basis, you want the billing process to be easy for the client. Stripe is one service that allows you to use a simple form (they have them pre-built) to bill a client using a credit card. You set up your account and then send the client the link to the form. If you bill on a monthly or quarterly basis, they handle recurring charges automatically for you.

Financial planning software comes in different shapes and sizes but all of them serve two purposes: laying out the path forward and a way to track progress.

The financial planning software you use should be simple enough that the client does not have any difficulty entering their information or accessing the information they need. It should have your business logo and contact information displayed.

For certain clients, you may choose to forgo online planning software and use a series of worksheets or Excel workbooks. Whatever you do make sure that they are easy to update and that the most recent version is always available.

One of the biggest roles of a financial coach is that of an accountability partner. Proactively reach out and check in on your clients to ensure that they are taking the actions needed to progress to the next step in their financial plan. Offer to schedule a meeting with them if you find they are off track. Continue to offer your support if they are on track.

These check-ins can happen in-person but the quick email or phone call is often enough.

The quarterly or annual reviews serve multiple purposes. They are a way to review the client’s progress and to incorporate that into the plan going forward. They also serve as an opportunity to provide guidance on any particular part of the plan that may be causing the client trouble or to help them deal with any challenges that may have cropped up.

Another function of reviews is to serve as a deadline. People are prone to procrastination but having a deadline coming up often prompts them to take action. If their next step from the last meeting was to update beneficiaries on their accounts (for example), they may put off doing that until the week before the next meeting.

Because of this dynamic, I always recommend to get the next meeting scheduled as the last order of business for any review. When you schedule a meeting, send a shared calendar invite so that the client does not need to take any action in order to get it on their calendar.

Taking this coaching process and packaging it up into something that you can repeat is the core of a financial coaching business. Take this framework and write down how you are going to use it with your clients. Think about the financial coaching software you are going to use for financial planning, tracking your client interactions, and scheduling your meetings. Like any business there is going to be marketing, sales, bookkeeping, and banking to take care of. Get help where you can so that you can focus on what you do best–helping people.

Book a demo today if you are an employer or financial advisor and are looking for an amazing financial wellness solution for your participants.