A Personalized Financial Plan for Every Participant

Help your participants reduce their financial stress and start achieving their financial goals.

Help your participants reduce their financial stress and start achieving their financial goals.

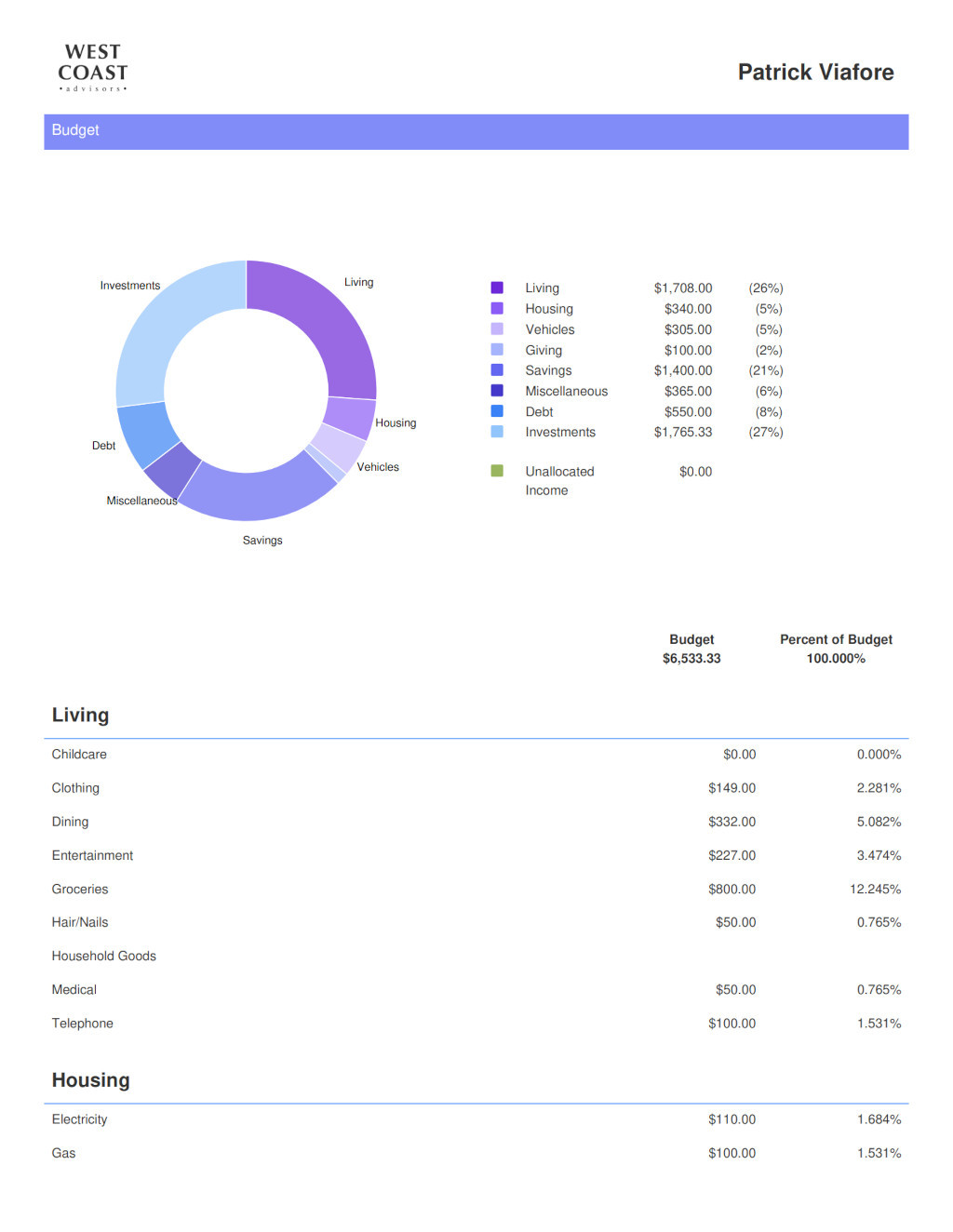

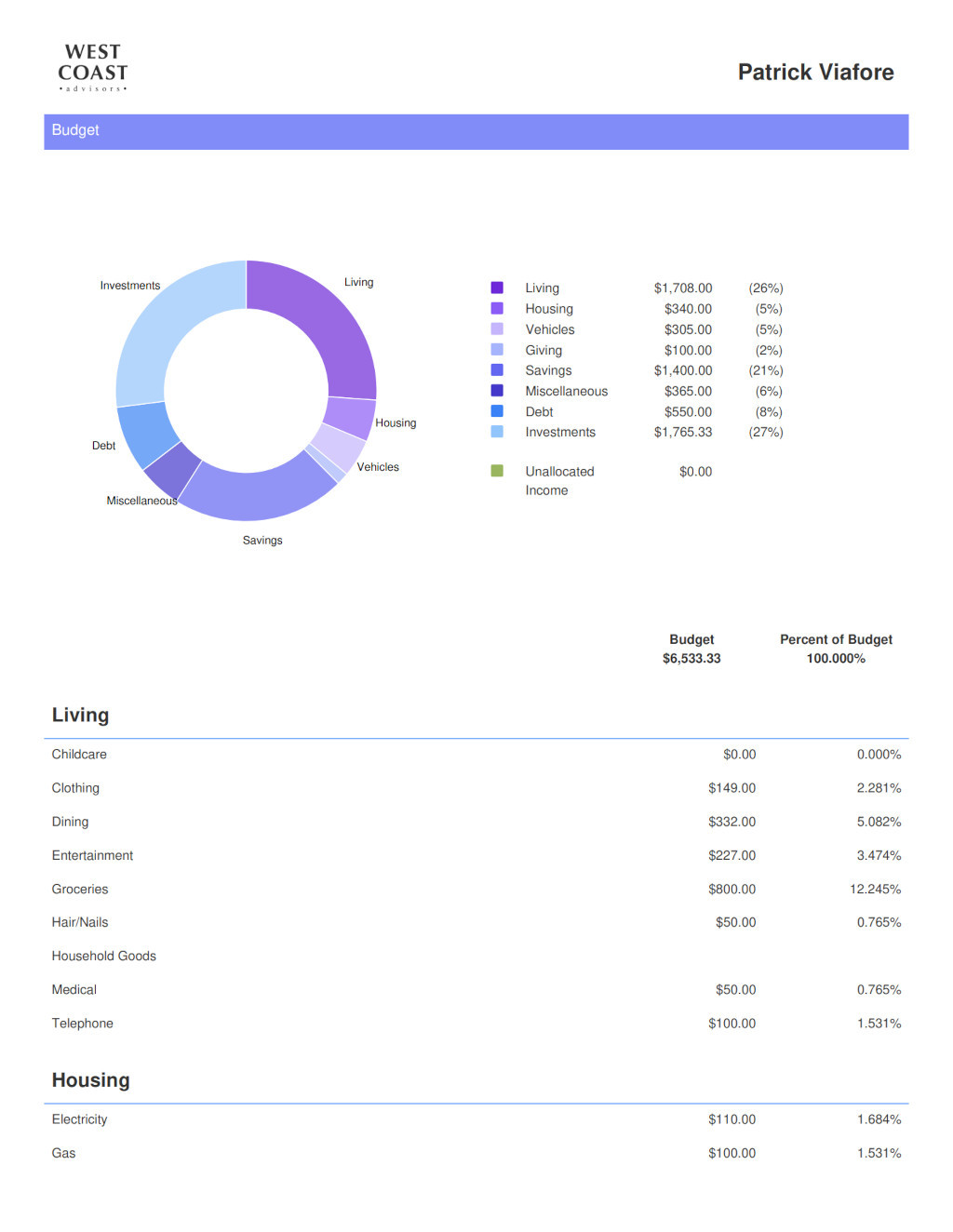

With the Wallet1000 financial wellness platform, your participants will receive a full financial plan which includes a budget, debt payment plan, insurance analysis, retirement projections, financial goal planning, and a series of actionable steps to move them forward on a lifelong path of financial health.

Less financial stress will help them better enjoy their time both inside and outside of work.

Employees who do not have their finances in order are more likely to put their retirement at risk by not contributing enough to their retirement accounts, by taking loans from their 401(k) plan, and by carrying too much debt into retirement.

Money is the top source of stress for Americans, and stress leads to health issues. Better employee health lowers healthcare costs for employers and lowers absenteeism. A huge win for both the participant and the plan sponsor.

A financial wellness program is a benefit for every employee no matter how much they can afford to save for retirement. The lessons and foundation the program provides will pay for itself many, many times over.

Can’t find the answer you’re looking for? Reach out to our team.

The financial plan includes a budget, debt payment plan, insurance analysis, retirement projections, financial goal planning, and a series of actionable steps to help your clients achieve those goals.

The assumptions are completely customizable which allows you to tailor the plan to your clients’ specific needs and circumstances.

Yes, Wallet1000 was designed to be easy to use and easy to understand. Each topic is presented in a simple and straightforward manner.’

Enter your contact information, and we will reach out and explore how Wallet1000 can help you grow your 401(k) business.