Sunday, August 16, 2020

Personal finances are front-and-center in 2020.

For decades to come we are going to be talking about 2020 as a watershed moment in finance. The most recent cataclysmic event will be the coronavirus rather than the great recession. Media coverage of the stock market will say, “The worst performance since the coronavirus outbreak” and possibly “The quickest rebound since the coronavirus recovery in 2020.”

For individuals, this recession is going to have a long-lasting impact on their household finances. Millions have lost their jobs and there might not be work for them in the future with entire industries being upended. The temporary boost to unemployment benefits helps but is not typically going to cover COBRA costs which could lead to more medical expense-induced bankruptcies in the future.

For those where unemployment is not enough to cover their expenses, which is most unemployed people now that the temporary increase has expired, they are burning through savings and using credit to pay the bills. They might be evicted or foreclosed on. The pause in their retirement savings due to losing access to their 401(k) plan will be felt decades in the future when they enter retirement.

The picture is not entirely cloudy. There are positive financial wellness themes we are seeing in 2020 as well.

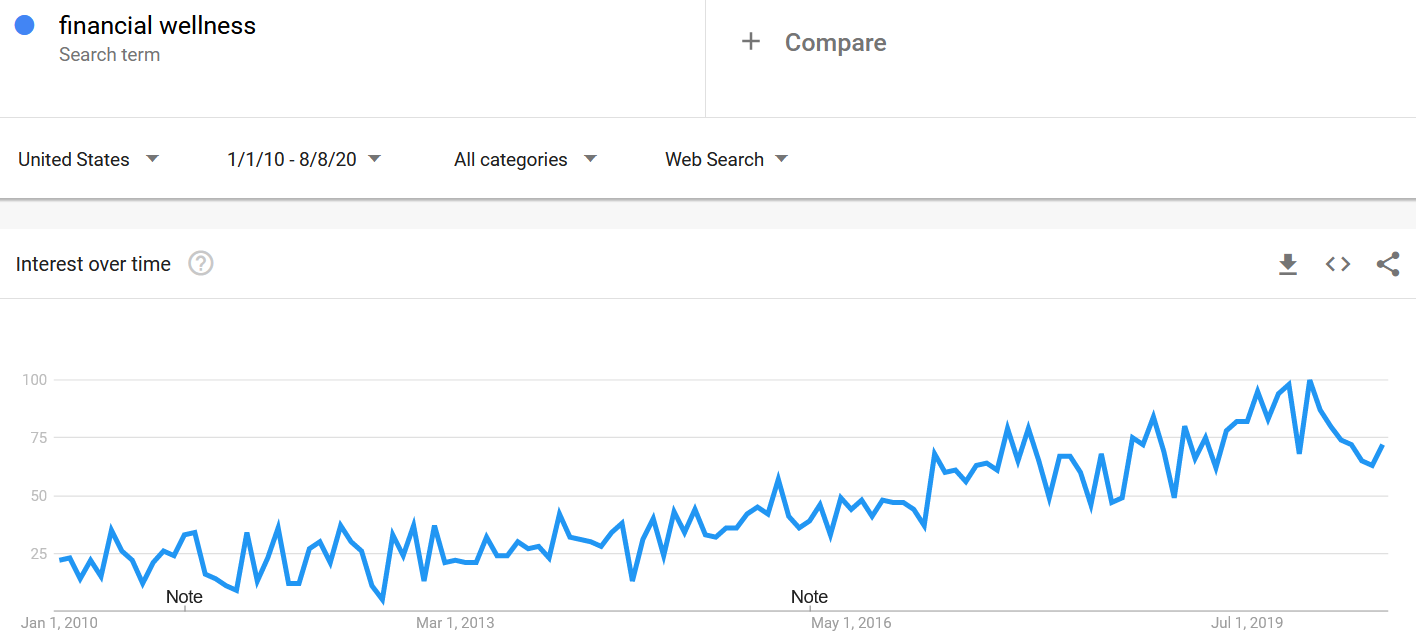

Even before the COVID crisis shined a spotlight on some of the more fragile parts of the economy, we were seeing that people are interested in improving their personal finances and building better lives for themselves and their families.

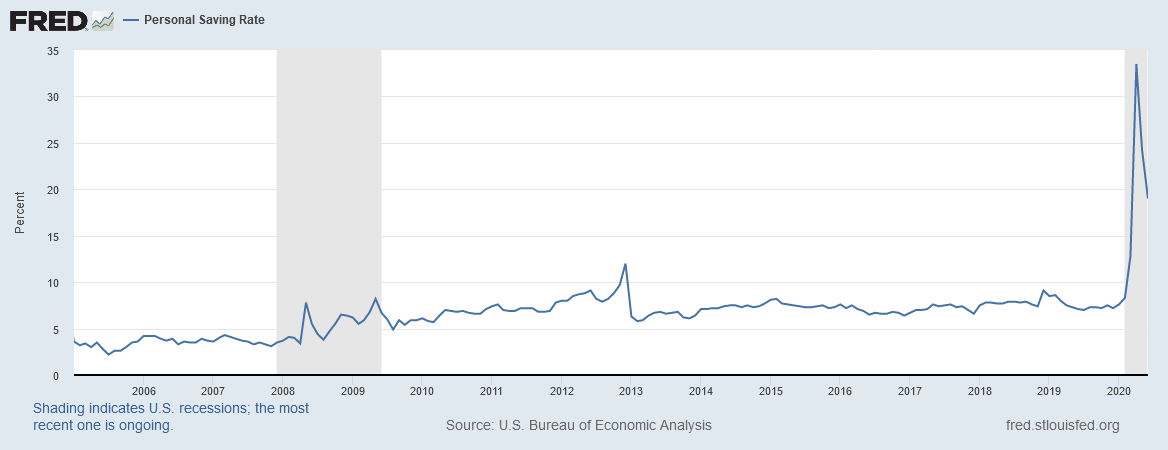

The personal savings rate has been climbing since 2005 as has interest in savings accounts (though not interest rates in savings accounts):

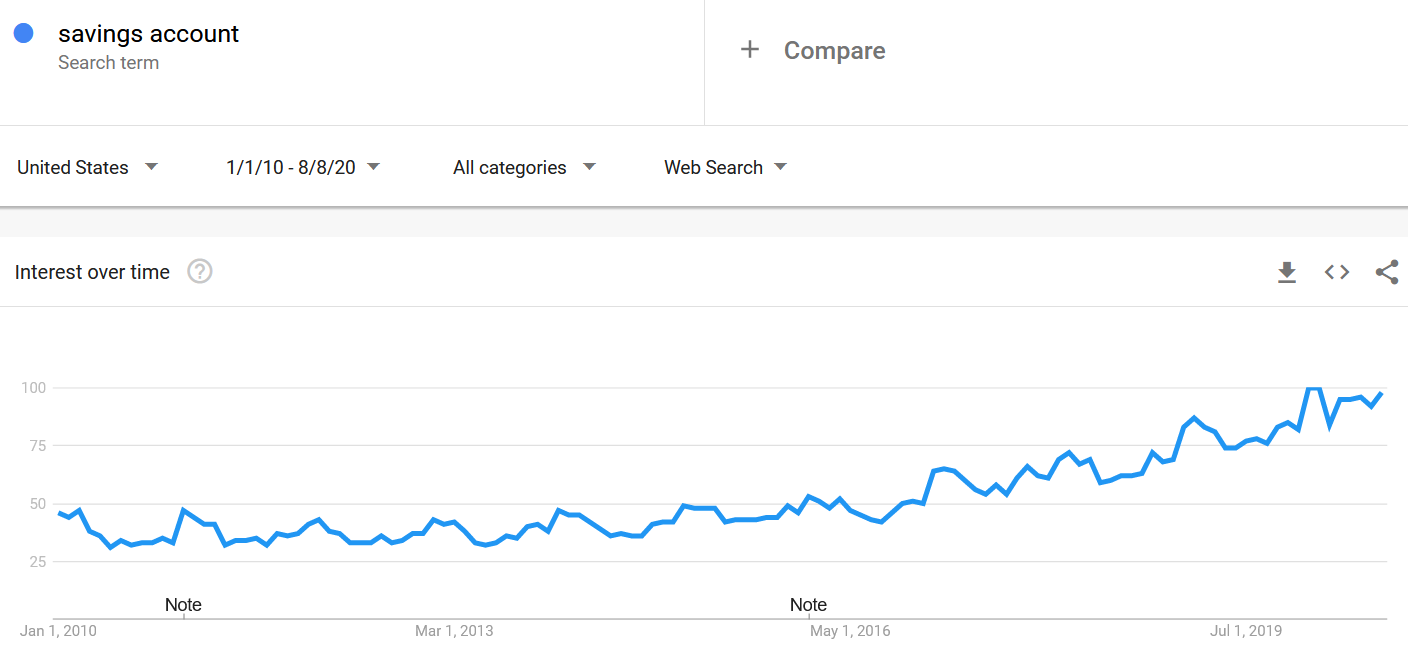

People want to get out of debt:

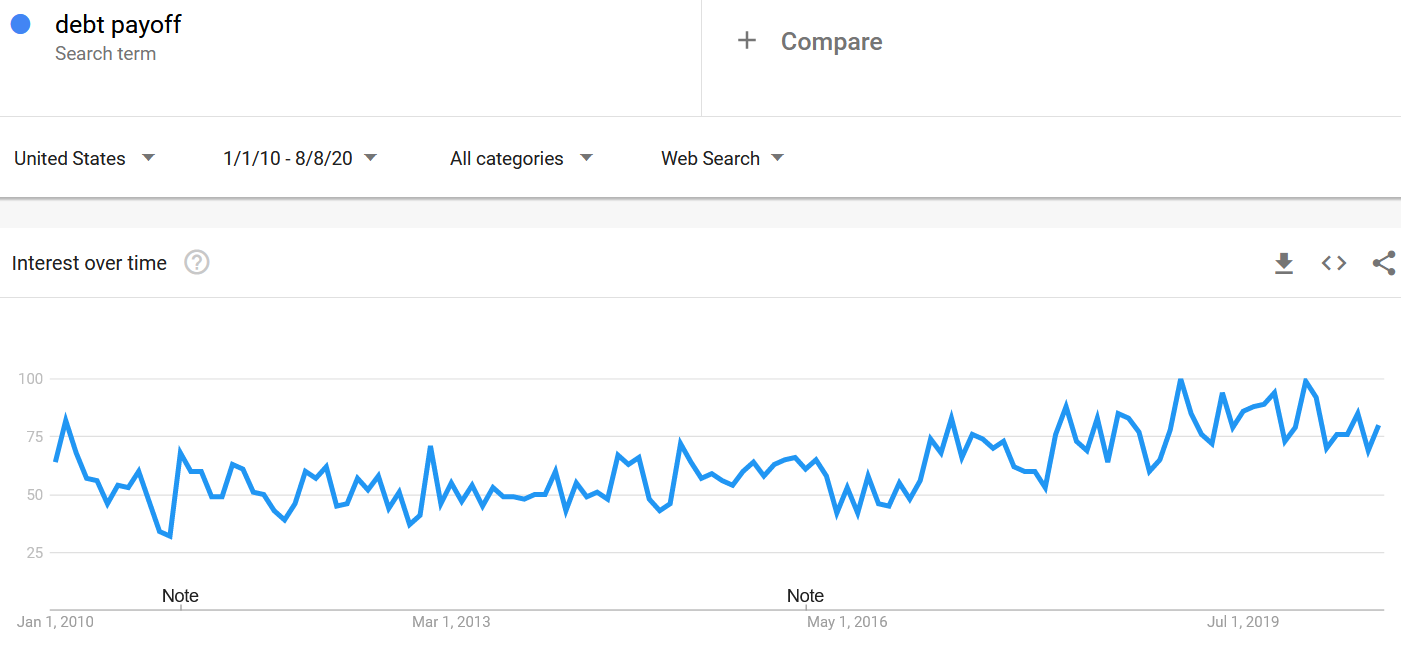

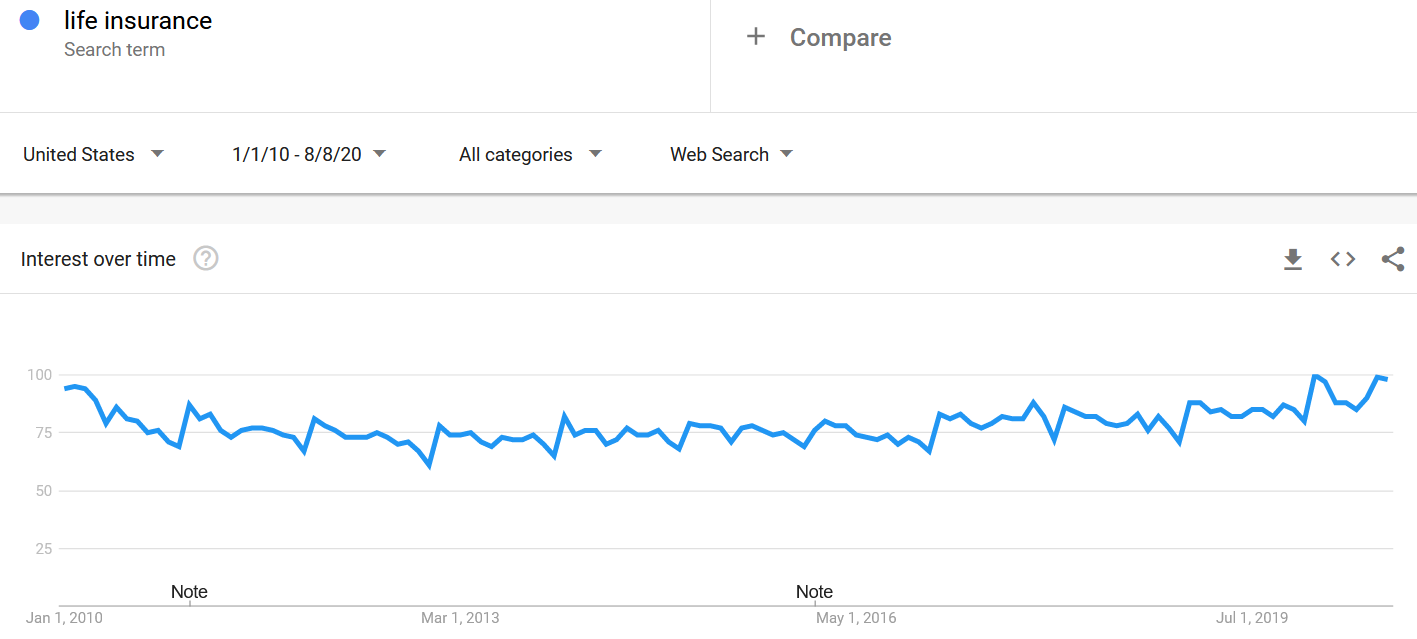

Plan for the worst:

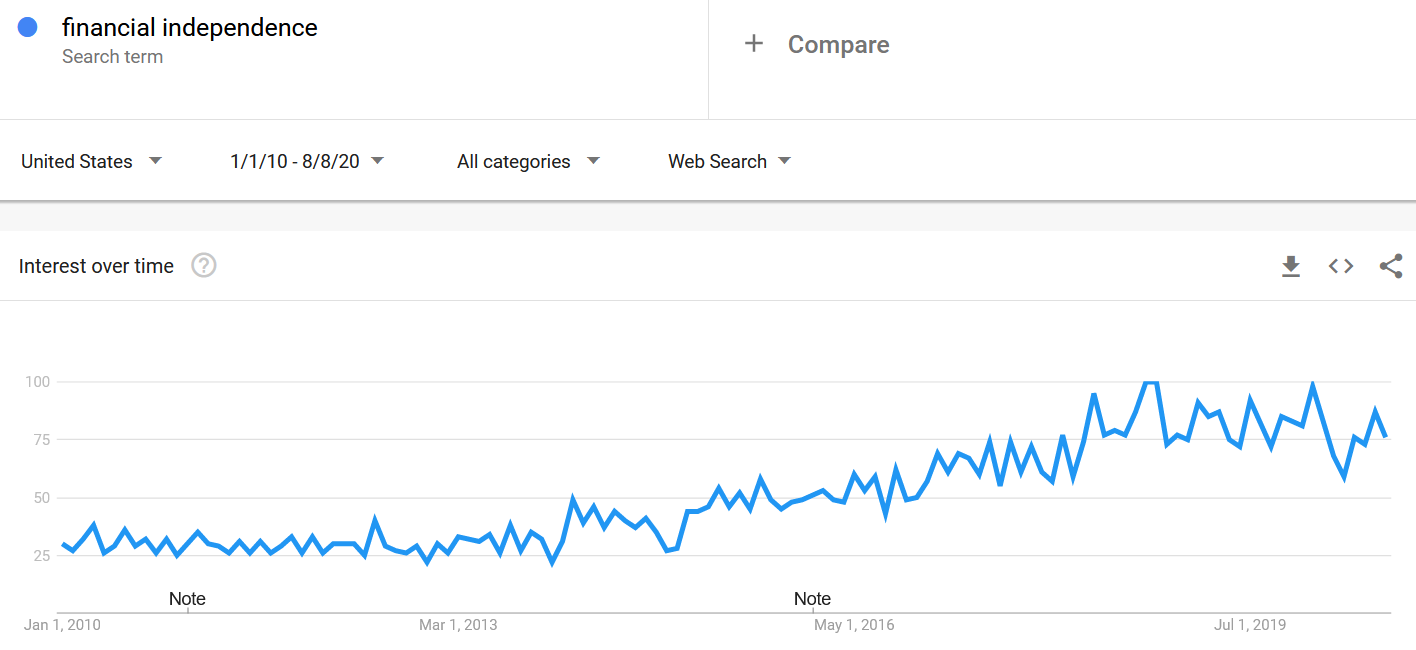

The financial independence retire early (FIRE) movement is growing:

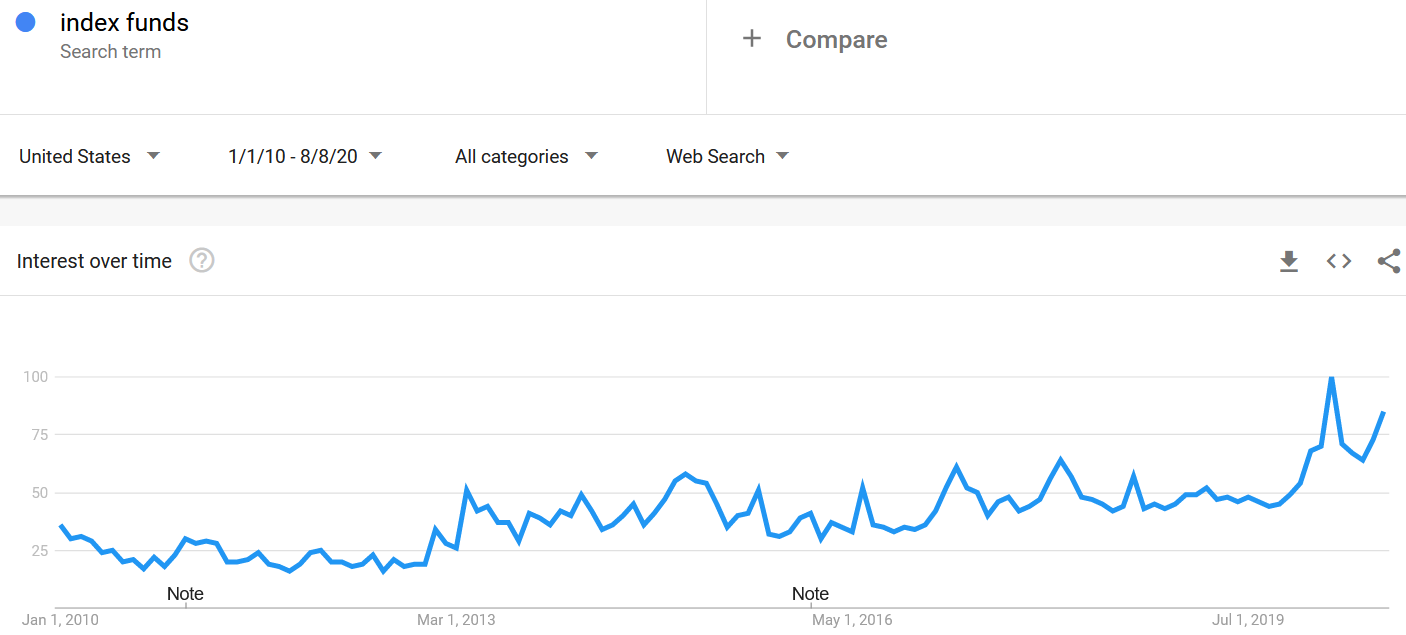

As well as index fund investing:

Employers are realizing that their employees are more engaged at work when they experience less stress outside of work. Helping their employees helps their bottom line.

However, interest is not evenly spread across all companies, all industries, or often even within a single company. You might see instances where a company or benefits committee sees financial wellness as another box they need to check in order to compete for employees when unemployment is low. Their search criteria might focus less on the effectiveness of a program and more on the cost. The videos and worksheets their recordkeeper provides might be enough for them.

At the other end of the spectrum are the more paternalistic companies and the ones that recognize that an employee taking an hour of time a month at work to deal with a financial matter far outweighs the cost of an effective financial wellness program. These companies will have an internal advocate who will champion the rollout and who will keep a close eye on the engagement rate. They want the program to succeed because they want their colleagues to succeed.

It is unfortunate that we are no closer to a consensus on the definition of financial wellness than we were five years ago. In fact, when we look at the wide variety of companies using the term, it feels like we are further away.

More and more we are seeing financial products marketed as financial wellness. Payday lending via an employer-sponsored app, student loan refinancing, and insurance are some things that I have seen employers and their benefits providers marketing to employees as financial wellness tools. Some of those have more merit than others, but I don’t believe they should fall under the umbrella of financial wellness.

I would suggest the distinction is that financial wellness is about education and planning. An advisor can offer both holistic financial wellness and life insurance but the selling of life insurance policies is just that…selling insurance. The selling of insurance is not financial wellness even if buying the policy contributes to someone’s financial health.

Financial wellness definition:

Financial wellness is being prepared for all major life events up to, and including, retirement.

While we are seeing downward pressure on fees industry-wide, there still are many companies–big and small–that are paying high fees on their 401(k) plan. This is a story that isn’t going away, nor should it, so advisors are increasingly going to have a hard time justifying their fees when their clients are getting constantly courted by other advisors.

An advisor would do well to spend some time carefully crafting their story including being able to explain–in easy to understand language–all of the fees a participant pays. Remember that a picture is worth a thousand words so consider a spreadsheet that shows each fee as a line item for the participant (as well as a before and after if there was fund or administrative changes).

Another tactic that an advisor can use to combat the fees questions is to provide more services and education. You might be charging a bit more but providing a lot more value than an advisor who treats the 401(k) as a lead funnel for the other products they sell. Make the apples-to-apples comparison work in your favor (you can even do a feature comparison chart like software products do). The ROI on financial wellness makes it a sound investment as long as it is done effectively with a focus on positive outcomes.

Unfortunately, what I don’t see happening in 2020, is more employers picking up the tab on the 401(k) plan costs rather than passing that on to their employees. Matches and lower investment expenses are amazing but the plan itself is less of a benefit for the participant when they pay for it themselves. Possibly, with more flat-rate investment advisory fees rather than AUM-based fees, we might see this happening in the future.

No personal finance situation exists in a vacuum. Every dollar that is spent in one area could possibly be better-used somewhere else. However, the holistic approach to financial wellness does have limitations–primarily the amount of time and effort it takes to do the planning. Financial wellness software, such as Wallet1000, can help both the advisor and the participant streamline the planning process but often a participant just wants to focus on the particular situation that is in front of them. It can be hard to focus on retirement planning when you are staring at a pile of medical or credit card bills.

Because of this I expect that focused, or situational, guidance will continue to be in demand from participants. They might engage about one topic, and then you might not hear from them again for many months, or even a year or more, as they work through their immediate issue. Once they are ready to tackle the next step you will hear from them again.

Situational financial wellness will negatively impact your engagement rate. (Our free Positive Participant Outcomes email course can help you keep your participants engaged and making progress towards their financial goals.) In these cases you might want to take a more qualitative approach and focus on the story and small wins that participants are making rather than the plan-wide metrics.

The coronavirus crisis is an opportunity for retirement plan advisors to refocus on the basic goal of helping their participants achieve their goal of a comfortable retirement. Financial wellness can be one avenue of that as well as a way to combat the commoditization of the 401(k) plan. However, within a few years every advisor is going to say they “do financial wellness” but the most successful advisors are going to be the ones that prove they deliver results.

Take your participant education to a new level with this free course about guiding participants to positive outcomes.