Wednesday, December 12, 2018

A simple exercise that encourages people to increase their 401(k) contributions

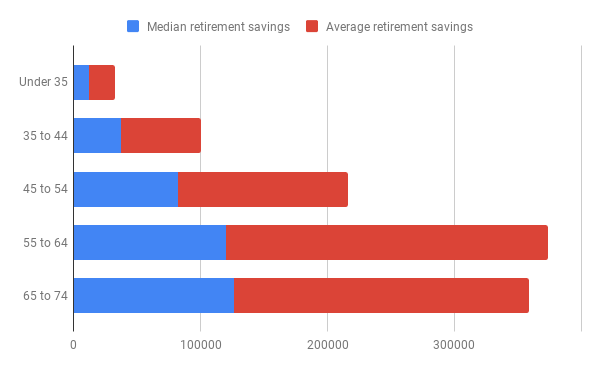

By and large people are not saving enough for retirement which is not news to anyone in the industry. The commonly reported average savings figures do not effectively capture the extent of the issue as not only are few retirement-ready but many are retirement-unlikely with little to nothing saved as they enter their 60s. These median retirement income savings statistics from Nerdwallet do a better job of illustrating the issue:

| Age bracket | Median retirement savings |

|---|---|

| Under 35 | $12,300 |

| 35 to 44 | $37,000 |

| 45 to 54 | $82,600 |

| 55 to 64 | $120,000 |

| 65 to 74 | $126,000 |

While there is alarm about the average retirement savings consider that the median retirement savings (across all age groups) is 64% below the average retirement savings!

We are not using the word crisis enough.

Our government has encouraged retirement savings through the creation of the 401(k), the IRA, Roth options, and HSAs. Advisors have been brainstorming ways to encourage their clients to save more since time immemorial. What most have found is that there is no single approach that works for any demographic let alone across all age groups and income ranges.

Two issues to highlight in particular:

The further away from retirement someone is the more theoretical this distance event becomes. One might fantasize about what they are going to do in retirement but they do not really spend time picturing it (the good and the bad). Because of the remote and conceptual nature of retirement it differs from other financial goals that can be achieved in shorter amounts of time, with less resources, and that result in something concrete. Additionally, and directly related, today’s problems trump tomorrow’s problems and forever will. Broken appliances and stacks of bills will always take precedence. (This underscores the positive effect that financial wellness education can have on retirement savings.)

However, there are some things that advisors can do to help participants image their future life. The book Save More Tomorrow - Practical Behavioral Finance Solutions To Improve 401(k) Plans has some suggestions including using software to age a picture of a participant so that they can better relate to their future, retired self. Another, and somewhat more practical, suggestion is presenting projected monthly income in retirement prominently on quarterly statements and leaving quarterly returns off of it entirely. The effect of this is shifting the focus from short-term returns to long-term results.

An exercise that I have had great success with focuses on the other side of the retirement coin–retirement spending. I have participants create a retirement budget now–possibly decades before they retire–which forces them to picture what their retirement is going to look like.

They use their current budget as a base and then work off of that. If they are on track for their house to be paid off then they can leave the mortgage payment off but will need to add a separate line item for property taxes. Hopefully cars will be paid off and without a commute to work their fuel costs will be less. If they retire away from family then travel costs will increase. More time to cook might increase the grocery budget and reduce the dining budget. Future medical costs are a big question mark but will inevitably be higher than they are today.

Only after they have finished creating a retirement budget that they deem realistic do we run their retirement income projection. More often than not there is a large gap between their projected spending and their investment and Social Security income. We can then break that gap down by their budget categories. “You’re going to have $500 less for food every month than you have budgeted for and might as well sell the car because you cannot afford auto insurance.”

When faced today with the hard decisions that they are going to have to make in the future participants are more likely to elevate retirement savings on their list of financial priorities. Today’s problems will still prevail over tomorrow’s but their current budget will get a closer inspection for spending that they can redirect towards improving their future self’s wellbeing.

Take your participant education to a new level with this free course about guiding participants to positive outcomes.